weekly options trading strategies pdf

Weekly options offer traders the ability to capitalize on short-term market movements with high volatility and profit potential. These strategies are ideal for both beginners and advanced traders‚ providing flexibility and regular income opportunities in all market conditions.

What Are Weekly Options?

Weekly options are a type of options contract with an expiration date set for each Friday‚ offering traders the opportunity to capitalize on short-term market movements. Unlike traditional options with longer expiration periods‚ weekly options expire every week‚ allowing traders to profit from volatility over a shorter timeframe. This makes them ideal for active traders who seek to hedge risks or speculate on price changes within a brief window.

Why Weekly Options Are Popular

Weekly options are popular due to their ability to generate weekly income and high returns in short time frames. They require less capital compared to longer-term options‚ making them accessible to more traders. The high volatility in weekly options offers significant profit potential‚ attracting both speculators and hedgers. Additionally‚ their flexibility in various market conditions and frequent expiration cycles provide traders with consistent opportunities to profit‚ making them a preferred choice for many.

Key Benefits of Weekly Options Trading

Weekly options trading offers numerous advantages‚ including the ability to generate regular income and capitalize on short-term market movements. With less capital required compared to longer-term options‚ traders can reduce investment risks while maintaining flexibility. The high volatility of weekly options creates opportunities for substantial returns in a short time frame‚ making them ideal for both hedgers and speculators. This strategy is adaptable to all market conditions‚ ensuring consistent trading opportunities.

- High-income potential in short periods.

- Lower capital requirements for entry.

- Flexibility in diverse market environments.

- Opportunity for weekly cash flow.

Advantages of Weekly Options Trading

Weekly options trading offers high volatility‚ profit potential‚ and flexibility in market conditions‚ allowing traders to generate consistent returns and adapt strategies to suit their goals effectively.

High Volatility and Profit Potential

Weekly options trading offers high volatility‚ creating significant profit opportunities in short time frames. Traders can capitalize on rapid price movements by leveraging strategies like buying calls during uptrends or puts during downtrends. The expiring nature of weekly contracts amplifies potential gains‚ allowing traders to repeatedly exploit market trends. However‚ this volatility also increases risk‚ requiring careful strategy and risk management to maximize returns while minimizing losses in fast-paced markets.

Flexibility in Market Conditions

Weekly options provide traders with exceptional flexibility to adapt to various market scenarios. Whether the market is trending upward‚ downward‚ or sideways‚ these options allow for tailored strategies to capture profits. Their short-term nature enables quick adjustments to changing conditions‚ making them ideal for both bullish and bearish environments. This adaptability makes weekly options a versatile tool for traders seeking to capitalize on volatility and market movements without long-term commitments.

Opportunity for Regular Income

Weekly options provide a unique chance to generate consistent income through strategic buying or selling of contracts. By leveraging short-term market movements‚ traders can create a steady income stream each week. Selling options‚ such as puts or calls‚ allows for regular cash flow with less capital required. This approach is particularly appealing for those seeking to supplement their income without long-term commitments‚ making it a popular choice for both novice and experienced traders alike.

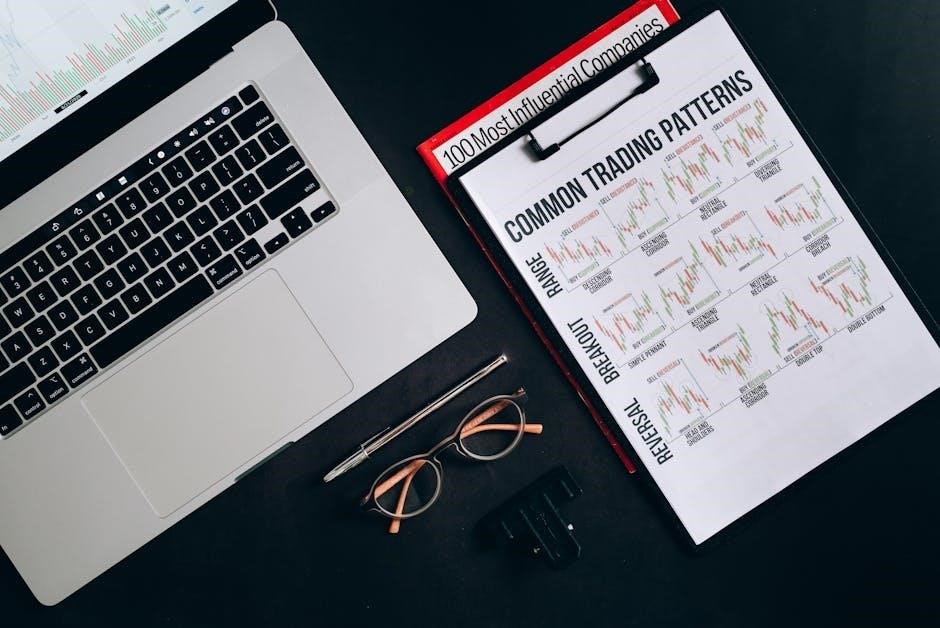

Basic Weekly Options Trading Strategies

Weekly options strategies include buying calls and puts for speculation‚ selling options for income‚ and combining positions for hedging‚ offering flexibility in various market scenarios.

Buying Call and Put Options

Buying call options is ideal when anticipating a price increase‚ allowing traders to profit from upward movements. Conversely‚ buying put options is suitable for bearish outlooks‚ enabling gains as prices decline. Both strategies offer flexibility and leverage‚ making them popular for short-term market predictions. Weekly options amplify potential returns due to high volatility‚ but require careful planning and risk management to avoid significant losses. This approach is simple yet effective for traders seeking immediate market exposure.

Selling Call and Put Options

Selling call and put options is a popular strategy for generating weekly income‚ especially in stable or slightly volatile markets. By selling options‚ traders collect premiums from buyers‚ profiting if the options expire worthless. This strategy requires careful analysis of market conditions and volatility. Selling weekly puts can also be effective when bullish on a stock‚ as it allows traders to capitalize on time decay while maintaining a lower capital requirement compared to buying options outright.

Combination Strategies

Combination strategies involve mixing different options contracts to maximize returns while managing risk. These include straddles‚ strangles‚ and iron condors‚ which combine calls and puts to profit from volatility or income. They allow traders to adapt to various market conditions‚ offering flexibility and hedging opportunities. By combining positions‚ traders can balance potential gains and losses‚ creating tailored strategies for both speculative and income-focused goals. These approaches are popular for their versatility in weekly options trading.

Advanced Weekly Options Trading Strategies

Advanced strategies like the Iron Condor‚ Straddle‚ and Calendar Spreads enable traders to exploit complex market movements‚ offering high returns with precise risk management in volatile conditions.

Iron Condor Strategy

The Iron Condor is a popular non-directional trading strategy that profits from market stability. It involves selling a call spread and a put spread on the same asset with different strike prices. This strategy thrives in low-volatility environments and is ideal for generating consistent income. By combining four options contracts‚ traders can collect premiums while limiting potential losses. The Iron Condor is favored for its balanced risk-reward profile and suitability for various market conditions.

Straddle and Strangle Strategies

Straddle and strangle strategies involve buying or selling combinations of call and put options with the same or different strike prices. These strategies are ideal for traders anticipating significant price movements. A straddle requires buying both a call and a put at the same strike‚ while a strangle uses different strikes. Both strategies aim to capitalize on volatility‚ offering high returns in turbulent markets. They are popular for their ability to profit from substantial price swings‚ making them suitable for experienced traders seeking advanced opportunities.

Calendar Spreads

A calendar spread involves buying and selling options with different expiration dates to exploit time decay. This strategy works best in stable markets‚ allowing traders to profit from the difference in option prices. By selling near-term options and buying longer-term ones‚ traders can generate consistent income. Calendar spreads are versatile and can be adjusted based on market conditions. They offer a balance between risk and reward‚ making them a popular choice for experienced traders seeking steady returns.

Risk Management in Weekly Options Trading

Effective position sizing and risk allocation are crucial. Implementing stop-loss orders helps limit losses‚ ensuring disciplined exits and protecting capital in volatile markets.

Position Sizing and Risk Allocation

Position sizing and risk allocation are critical for managing weekly options trades. By sizing positions appropriately‚ traders can avoid overexposure to market volatility. Allocating risk across multiple trades ensures portfolio protection and balances potential losses. Proper allocation strategies prevent overleveraging and allow for consistent returns. Diversification and disciplined risk management are essential for long-term success in weekly options trading‚ ensuring sustainability and minimizing financial stress.

Stop-Loss Orders and Exit Strategies

Stop-loss orders are crucial for managing risks in weekly options trading‚ helping to limit potential losses. Exit strategies‚ such as closing positions before expiration or at predefined price levels‚ ensure disciplined trading. These tools prevent emotional decisions and protect capital. Implementing stop-loss orders and exit plans is essential for maintaining consistency and long-term success in volatile markets.

Psychological Aspects of Weekly Options Trading

Emotional discipline and mental fortitude are crucial in managing high-pressure trading environments. Controlling greed and maintaining focus ensures better decision-making and long-term success in weekly options trading strategies.

Mental Discipline and Emotional Control

Success in weekly options trading requires mental discipline and emotional control. Managing fear and greed is crucial‚ as they can lead to impulsive decisions. Staying focused on your strategy helps navigate market fluctuations. Avoid chasing quick profits and stick to your plan. Managing expectations prevents overtrading and maintains a clear mindset‚ essential for consistent results and long-term success.

Managing Expectations and Greed

Managing expectations and greed is crucial in weekly options trading. Setting realistic goals helps avoid overtrading and chasing unrealistic profits. Greed can lead to poor decisions‚ such as holding losing trades too long or risking excessive capital. Stay disciplined‚ focus on consistent gains‚ and avoid letting emotions dictate your strategy. Balancing ambition with risk awareness ensures sustainable success in volatile markets.

Market Analysis for Weekly Options Trading

Effective market analysis is crucial for identifying trends and making informed trading decisions. Combining technical and fundamental analysis helps traders optimize their weekly options strategies.

Technical Analysis Techniques

Technical analysis is crucial for identifying trends and patterns in weekly options trading. Traders use tools like moving averages‚ RSI‚ and Bollinger Bands to predict price movements. By analyzing charts and candlestick patterns‚ traders can spot entry and exit points‚ maximizing profits. These techniques help in making informed decisions and adapting to volatile market conditions effectively. Combining multiple indicators enhances accuracy and strategy execution in weekly options trading.

Fundamental Analysis Approaches

Fundamental analysis involves examining a company’s financial health‚ industry trends‚ and economic conditions to predict stock price movements. For weekly options‚ traders analyze earnings reports‚ economic indicators‚ and news events to identify potential price changes. Staying updated on company-specific news‚ such as product launches or management changes‚ and sector-wide developments can provide valuable trading opportunities. This approach helps in making informed decisions‚ such as buying calls or puts‚ based on expected stock reactions to fundamental factors.

Probability and Statistics in Weekly Options Trading

Understanding probability and statistics is crucial for weekly options trading. Key concepts include implied volatility‚ probability of profit‚ and statistical models to predict market behavior‚ enhancing trading decisions and risk management.

Understanding Implied Volatility

Implied volatility (IV) is a critical factor in options pricing‚ reflecting market expectations of future price fluctuations. Higher IV levels indicate greater uncertainty‚ leading to higher option premiums. For weekly options‚ IV is particularly dynamic‚ as it reacts swiftly to market news and expiration deadlines. Traders use IV to gauge potential price movements and make informed decisions. Monitoring IV changes helps identify profitable trades and manage risks effectively in short-term strategies.

Probability of Profit and Loss

Understanding the probability of profit and loss is crucial for refining weekly options strategies. By analyzing implied volatility and historical data‚ traders can estimate the likelihood of an option expiring in-the-money. This statistical approach helps in making informed decisions‚ balancing risk and reward effectively. Weekly options’ short expiration cycles amplify time decay‚ making precise calculations essential for maximizing returns and minimizing losses in volatile markets.

Case Studies and Real-World Examples

Traders share successful strategies like selling weekly put options for steady income. Real-world examples highlight how high volatility and short-term trends can be harnessed effectively for profits.

Successful Weekly Options Trades

Weekly options trades can generate consistent profits when executed with well-defined strategies. Selling put options during bullish trends and buying calls in uptrends are common approaches. Traders often leverage high volatility for quick gains‚ while others focus on income generation through premium selling. Successful trades require discipline‚ market analysis‚ and risk management to maximize returns and minimize losses in fast-paced markets.

Lessons Learned from Failed Trades

Failed trades often highlight overleveraging and improper risk management. Many traders underestimate market unpredictability and emotional bias‚ leading to poor decisions. These experiences emphasize the importance of discipline‚ sticking to plans‚ and continuous learning. Analyzing losses reveals the need for better research and realistic expectations. These lessons are invaluable for refining strategies and achieving long-term success in weekly options trading.

Mastering weekly options trading requires consistent learning and practice. By combining strategies with risk management‚ traders can achieve steady income and long-term success in the markets.

Summarizing Key Strategies

Effective weekly options trading involves strategies like buying calls/puts‚ selling options‚ and combining positions. These approaches allow traders to capitalize on market movements‚ generate income‚ and hedge risks. Proven strategies from resources like “Options Trading: How to Turn Every Friday into Payday” and “Selling Weekly Options Cheat Sheet” emphasize disciplined execution and adaptability. Regular income generation and risk management are core focuses‚ ensuring sustainable trading success in volatile markets.

Continuing Education and Improvement

Continuous learning is crucial for mastering weekly options trading. Utilize resources like PDF guides‚ books‚ and online courses to deepen your understanding. Structured lessons and practical examples help refine strategies. Join forums and communities to share insights and stay updated on market trends. Regularly reviewing trades and adapting techniques ensures long-term success in this dynamic field.